By: – WSJ Financial Satire Section

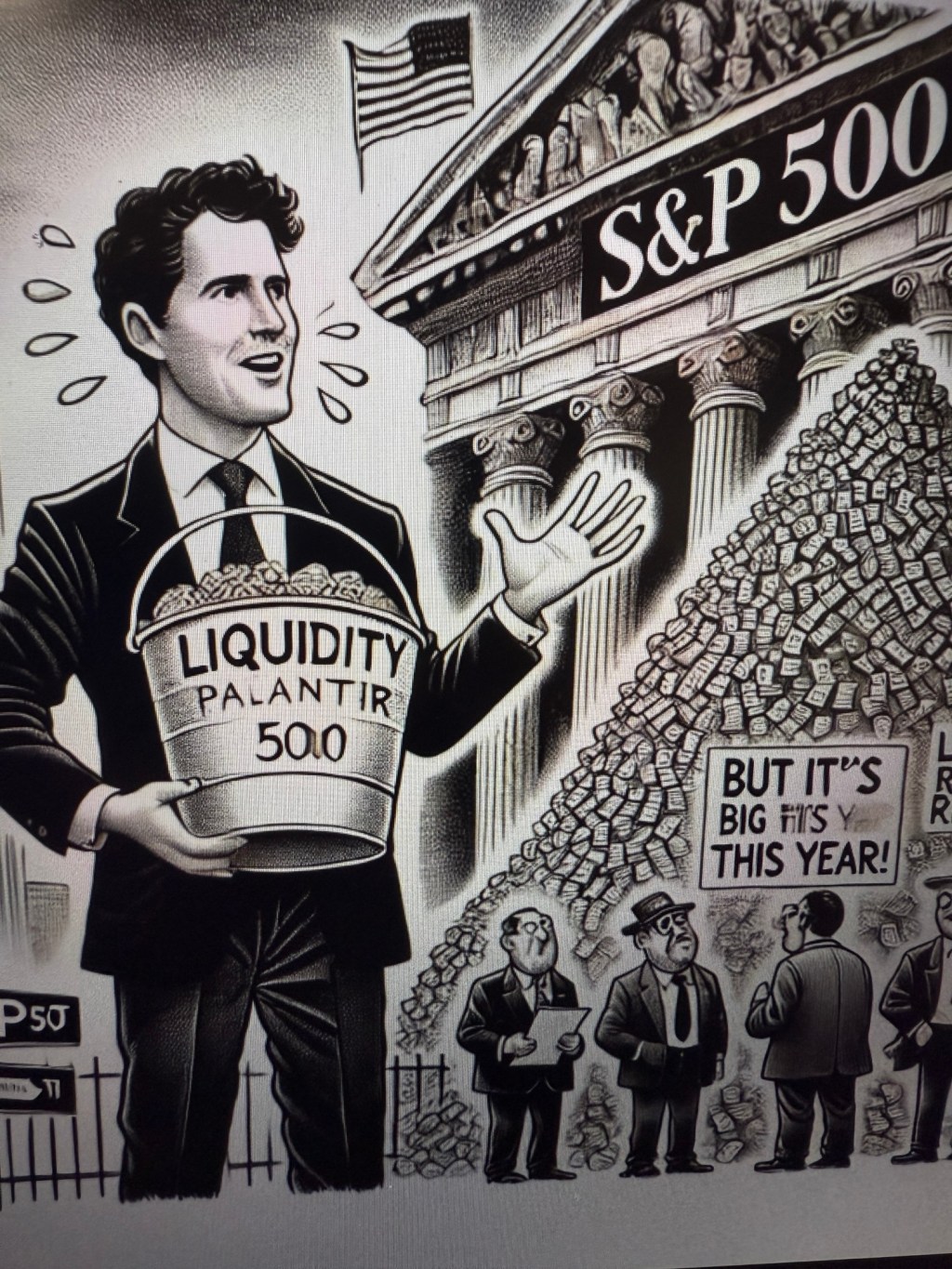

In a shocking development that absolutely no one saw coming, Palantir CEO Alex Karp has undertaken the arduous task of selling over $300 million of his personal stake in Palantir. No, this isn’t because he’s planning to buy a small country (though he probably could). It’s because, ladies and gentlemen, Palantir must finally achieve what it’s been striving for: entry into the coveted S&P 500. And there’s only one thing standing in its way: liquidity! Yes, the stock that’s been up 150% this year still can’t make it into the big leagues because, apparently, no one can actually buy enough of it.

Karp, being the altruistic leader he is, took one for the team. “I’ve tried everything,” he was overheard muttering while divesting his shares, “but the S&P won’t take us unless someone can trade this stuff!”

After consulting with Palantir’s finest data models and a crystal ball, Karp realized there was only one solution: unload $300 million in stock and give the people what they want—actual liquidity. Rumor has it, he also considered hosting a Black Friday-style flash sale on shares, with coupons redeemable for free Palantir swag, but the lawyers quickly vetoed that.

What’s really hilarious is that some people (you know who you are in that investment group) actually think this means the end is near. “He’s dumping his stock! It’s over!” they cry, sipping their lattes as if they haven’t seen this movie before. They forget that Karp still has 90% of his shares. Ninety. Percent. If this were poker, Karp’s still holding the royal flush, and you guys are folding over a pair of sevens.

So why would Karp need to sell? Well, in a financial landscape where people are screaming “liquidity crunch!” like it’s the end of days, Palantir’s stock was essentially the financial version of a rare Pokémon card: valuable, but no one can find one to actually buy. “You think Palantir’s stock is overvalued?” one investor was heard saying. “That’s only because you can’t get your hands on it.”

Palantir’s meteoric rise this year hasn’t exactly been fueled by retail traders stuffing their Robinhood accounts. No, the stock has been more elusive than Bigfoot, and the S&P 500 committee—those stalwart guardians of liquidity—said, “Sorry Alex, we’d love to let you in, but your stock’s as hard to find as toilet paper in 2020.”

So there you have it, dear investors. Karp didn’t sell because he’s abandoning ship. Oh no. He did it because someone had to finally pump some stock into the market. Karp’s selling is like a liquidity IV drip for the thirsty financial market. Now, if you’re still convinced that Palantir’s golden days are over, well, maybe you’re just not ready to play in the big leagues with the S&P 500.

In the meantime, Karp is probably back in his fortress of data, basking in the knowledge that his strategic move is one step closer to making Palantir the most liquid stock in the land. Let’s not forget the real irony here: you’re all complaining about him selling shares, but without this sale, good luck finding enough stock to dump when it hits $50.

Written with a wink and a nod for all the “skeptics” out there.

Leave a comment